Resources for navigating transitions

Estate, Long-Term Care and Medicaid Planning

Helpful Resources

Medicaid Myths

Separating the Myths from the Facts

Protecting Your Assets

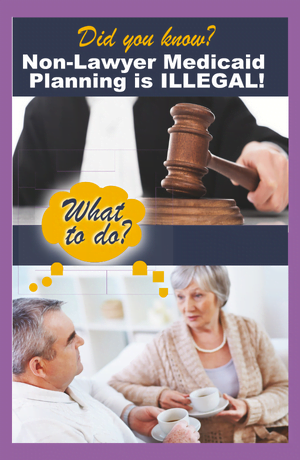

Using a Florida Licensed Attorney for Medicaid Planning

FAQ’s

Common Questions and Terms

Protecting Your Assets

Helping elders and their families plan for long-term care.

Creating or updating an estate plan is a critical step later in life–not only to protect your assets but also to make sure that your loved ones have the tools and guidance they need to fulfill your wishes and help you plan for long-term care.

We’re the perfect fit

Amy Dow Elder Law is a boutique Florida law firm dedicated to helping guide you through the decision-making and planning process. This includes addressing how your assets can be protected against the soaring cost of care and how you want your estate distributed. Amy’s team documents your choices and strives to make this process accessible, understandable and affordable. With a unique personal touch and a spirit of compassion, Amy works directly with every family to ensure that their needs are met and they are getting the best legal guidance and representation possible.

Medicaid Myths

Many people hesitate to do Medicaid planning because of common misunderstandings. Medicaid concepts you should know:

The average monthly cost for a nursing home in Florida is more than $8,500 per month–and plans such as Medicare and Humana do not pay for long-term stays.

Clients frequently think they must spend all their assets before they can be eligible for Medicaid, or that Medicaid will take their home. However, with proper Asset Protection Planning, you or your loved one can become eligible by “sheltering” your assets and life savings.

Giving your money or your home to your kids may be allowed under the tax code but doing so may trigger penalties when you apply for Medicaid.

Many Floridians who have moved from other states think it is too late to plan for Medicaid. However, the laws in Florida are different than most other states and it is usually never too late to plan or apply.

Many people are afraid to apply for Medicaid because they do not want their loved one to be in a “Medicaid Facility”. However, virtually every nursing home in Florida accepts a certain number of Medicaid residents.

FAQ

A prudent question is one-half of wisdom – Francis Bacon

What are Advance Directives?

If you are 18 or older, you should have Advance Directives. These are legal documents that tell the world what you want and who can speak for you at a time when you may not be able to do so yourself. Advance Directives include a Durable Power of Attorney, a Living Will, and a Health Care Surrogate Designation or Proxy. A Living Will tells family and medical providers the kinds of treatment you would want in an emergency. The Health Care Surrogate or Proxy is the person who can speak for you regarding these matters. In a Power of Attorney document, you designate a trusted person who can help you manage your financial affairs.

Why should parents have Advance Directives for their college age or young adult children?

Without Advance Directives, parents do not have the legal authority to make health care decisions or manage money for their children once they turn 18. Although some laws allow for next of kin to act in this capacity, parents don’t always agree about what their child would want. This could mean that if a young adult is in an accident or becomes disabled, even temporarily, a parent might need court approval to act on his or her behalf.

How do I name a guardian for my children should something happen to me?

Parents should have a Pre-need Guardian Designation for their children in case the unexpected happens. It is often not enough for you to simply let family members know what you want. If your choice is not documented properly, this process may result in a complicated legal battle in court.

Why can’t I use those simple online forms or documents created in another state?

Although on-line forms or out-of-state documents may be legally valid, they could prove to be insufficient for your needs. On-line forms are often generic, cover only limited situations, and do not always do what you want them to do. Out-of-state documents may contain provisions that meet specific requirements of the state in which they were drafted. However, because states vary, and because laws change, it is important to keep your documents up-to-date and consistent with the laws where you live.

What is the difference between a Living Will and a Will?

A Living Will is a document that states what kind of health care you wish to receive, or refuse to receive, should you lose consciousness or capacity. A Will OR Last Will and Testament, gives instructions for how you want your property and assets distributed after you die.

How do we know if we need a trust?

There are many types of trusts – revocable, irrevocable, etc. Amy will explain how they each work and help you select the trust that meets your goals. If you have estate planning related legal questions or needs, schedule a consultation directly with Amy.

Google 5-Star Reviews

Amy Dow, Co-Author,

Florida Bar Booklet

Elder Law attorneys help you LEGALLY protect your assets when applying for Medicaid.